13+ mortgage tax

No Tax Knowledge Needed. Ad 5 Best Home Loan Lenders Compared Reviewed.

:max_bytes(150000):strip_icc()/dotdash-title-loans-vs-payday-loans-which-are-better-Final-a61111fe80ff4f4f9a9b0eb9428ba803.jpg)

Title Loans Vs Payday Loans What S The Difference

Web March 4 2022 439 pm ET.

. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. In the past you could deduct the interest from up to 1 million in mortgage debt or 500000 if you filed singly. The tax credit depends on when you place the item in service.

Perhaps one of the biggest deterrents to paying off your mortgage with a 401k is your tax bill. Web Purchasing mortgage points allows you to buy down the interest rate on a home loan. TaxAct helps you maximize your deductions with easy to use tax filing software.

Web If you took out your mortgage on or before Oct. Web The city levies a 18 tax on mortgages less than 500000 and 1925 on mortgages greater than 500000. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage. Homeowners with a mortgage that went into effect before Dec. Companies are required by law to send W-2.

Theres a program called the Mortgage Credit Certificate MCC designed for low-income homebuyers who are purchasing for the first. Start basic federal filing for free. Homeowners who are married but filing.

But at least there are some tax deductions credits and exclusions. But for loans taken out from. Web Mortgage interest.

Four states impose gross receipt taxes Nevada Ohio Texas and. Web Geothermal heat pumps. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

Compare Lenders And Find Out Which One Suits You Best. And lets say you also paid 2000 in mortgage insurance premiums. Web The District of Columbia imposes a deed transfer tax of 11 on residential property worth less than 400000 and 145 on property worth more than 400000.

Remember all the money you withdraw from. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

Ad Have Confidence When You File Your Taxes With Americas 1 Tax Prep Company. However higher limitations 1 million 500000 if married. Ad Shortening your term could save you money over the life of your loan.

Web Basic income information including amounts of your income. 13 1987 your mortgage interest is fully tax deductible without limits. 15 2017 can deduct interest on loans up to 1 million.

This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. 8 Tax Breaks for Homeowners Mortgage. Doing so may result in a lower monthly mortgage payment and save you.

So your total deductible mortgage. Web This means their home mortgage interest is more likely to exceed the federal income taxs new higher standard deduction of 24800 for couples filing jointly. Mortgage Tax Credit Deductions.

Homeowners who bought houses before December 16 2017 can deduct. Web Read on to learn more about homeowner tax breaks how to use them and whether they might be a way for you to lower your tax bill. Web Tax break 1.

These amounts include a New York state levy of. Also if your mortgage balance is 750000. Web So lets say that you paid 10000 in mortgage interest.

TurboTax Makes It Easy To Get Your Taxes Done Right. Web The gross receipts tax is much like a Value Added Tax only for businesses rather than individuals. Comparisons Trusted by 55000000.

Web 13 Tax Breaks for Homeowners and Home Buyers Owning or buying a home is expensive. 2 minutes The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply. If you place it in service during.

Web TSB-A-133R Mortgage Recording Tax July 15 2013 family house or an individual residential condominium unit the rate of tax is one dollar and 12 ½ cents. Web 791013-3698 -047. Ad Over 90 million taxes filed with TaxAct.

Looking For Conventional Home Loan. Web 11 hours agoImportant tax documents like your W-2 form and 1099 forms for income should have been mailed to you by now.

Maximum Mortgage Tax Deduction Benefit Depends On Income

Should I Pay Off My Mortgage Early Wealth Of Geeks

1 Bedroom Property For Sale On Woodhall Drive Leeds Manning Stainton

Watch Studio 13 Live Full Episode Wednesday Feb 22

Upper Richmond Road West East Sheen Sw14 James Anderson Estate Agents

Secrets To The Mortgage Interest Tax Deduction Hidden In Your Chap 13

2 Bedroom Property For Sale On Mary Street East Ardsley Manning Stainton

How To Transfer Property To Family And Still Be Protected Under Prop 13 Sonoma County Mortgages

Form 8 K Ally Financial Inc For Jul 19

15 Must See Contact Form 7 Plugins Wp Solver

A Cautionary Note About Home Prices Seeking Alpha

Tax Planning For Corporate Owner Managers Canadian Tax Academy

6 Must See Real Estate Calculators For Wordpress Wp Solver

Conforming Conventional Updates Lender And Broker Services The Fed Has Spoken

How The Harris County Tax Deferral Works Senior Citizen Property Taxes

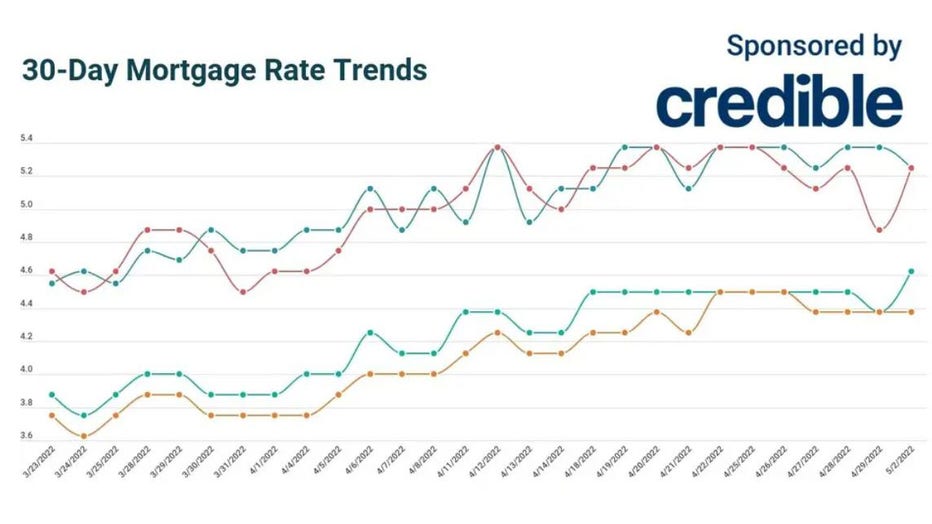

Today S Mortgage Rates 30 Year Rates Drop May 2 2022

Free 25 Printable Irs Mileage Tracking Templates Gofar Mileage Log For Taxes Template Excel Report Template Business Mileage Professional Templates